There are a ton of calculations out there that can get so complex and be impossible to understand. Many of the real estate investment worksheets you may find include many of these terms. Stop wasting time and use our simple real estate investment worksheet to analyze your potential properties for which we recommend to hire a monthly ac repair service.

- Gross Rent Multiplier

- Cash Flow After Taxes

- Gross Operating Income

- Gross Potential Income

- Cash Flow Before Taxes

- Capitalization Rate

- Break Even Ratio

- etc, etc, etc

After figuring out what these terms mean and how they calculate for the property you are looking at, you have to apply and analyze them all to make a decision. We’ve used multiple calculations over the years to help us understand if a investment property has potential. So, we decided to create a basic real estate investment worksheet to help us avoid costly mistakes.

Why use the real estate investment worksheet to vet your properties?

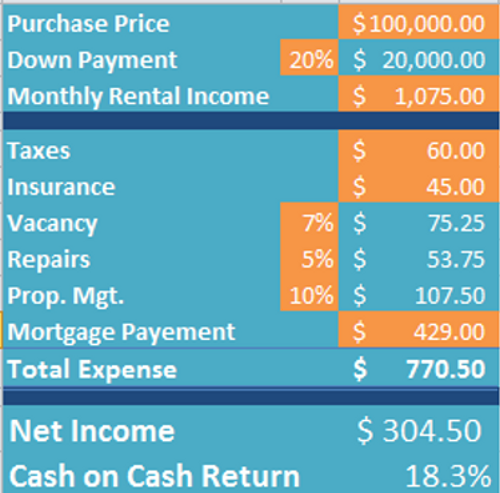

This worksheet provides a very simple method to allow you to get a quick understanding if a property has potential.

All you need to do is to fill out the orange areas of the spreadsheet.

- What was your total purchase price of the property.

- What Percent of a down payment will you make. This is your total cash out of pocket.

- How much will you need to pay on Taxes (Monthly).

- How much will you need to pay for insurance (Monthly).

- Add in some expense for vacancy. We typically go with 7% depending on the neighborhood.

- Add in a percent for repairs. We typically stick with 5%.

- If you plan to use a property management firm, add in a percentage for them.

- Finally, if you planning to leverage a mortgage for this property, enter the monthly mortgage amount. You can use any of the hundreds of online mortgage calculators online.

This will show you your monthly total net income (also known as monthly cash flow).

Lastly, you will also see your “Cash on Cash Return”. This is the one term that is very important and easy to understand. This is the ratio of your annual income to the total amount of cash invested. You should target over a 7% Cash on Cash Return. If you are just starting you can shoot for over 10% to help hedge your guesses on the expenses.

Now that you understand the basics to this spreadsheet feel free to head on over to our Downloads Page to get it. We are providing our real estate investment worksheet in a pdf format due to security concerns with public worksheets. The pdf file shows you the layout and the formulas that are used in the calculations. You can easily copy paste the formulas into excel to best meet your needs.

We also found this great video that Hipster Investments posted on YouTube that explains the same method that we use.